How to Invest in Real Estate Without Money or Credit

Entering the property market without upfront funds or credit is challenging, but inventive approaches open doors. By leveraging wholesaling, seller financing, lease options, and partnerships, you can control properties and generate income with minimal personal capital. We’ll delve into actionable techniques for securing and monetizing property rights without banks.

Discover more about investing without cash or credit, visit: real estate investor lead generation software

Innovative No-Money-Down Techniques

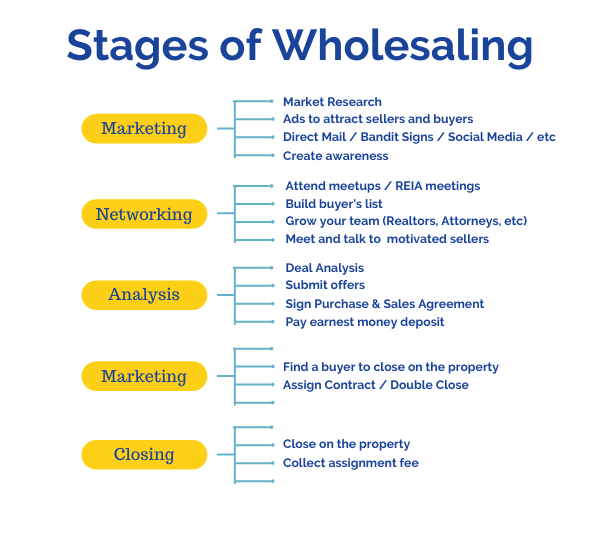

By wholesaling contracts at a discount, you earn assignment fees without a mortgage or credit requirement. With wholesaling, no personal capital or credit checks are required, yet profits can be realized quickly. Thriving in wholesaling requires pinpointing distressed properties, calculating ARVs, and cultivating a reliable investor network.

Owner Carryback and Rent-to-Own Strategies

With seller carryback, the owner acts as the lender, enabling you to acquire the property without a bank. Rent-to-own agreements allow you to lease now and buy later under agreed terms. These methods give immediate property control and deferred payment responsibilities.

Joint Ventures & Partnerships

Joint ventures allow you to contribute market knowledge while your partner provides funding. Profit-share agreements divide returns based on each party’s contribution, aligning interests and minimizing personal risk. Clear communication, legal documentation, and shared goals are vital for successful real estate partnerships.

Tools & Resources for No-Cash Investing

Leveraging CRM and deal-analysis software streamlines lead tracking and property evaluation. Digital hubs for real estate investing often feature exclusive no-money-down deal listings. Resources like WholesalingHousesInfo.com best real estate investing blog provide step-by-step guidance and community support for leveraging creative financing.

Best Practices for No-Money-Down Deals

Detailed research on ownership and repair needs protects your profits and reputation. Develop a robust cash-buyer list or funding partners to ensure swift assignment and closing. Master persuasive communication and clear value presentation to negotiate favorable terms with sellers and investors.

To learn more about alternative real estate investing methods, go to: house flipping software

Wrapping Up Creative Financing Strategies

While unconventional, no-money-down techniques can yield substantial returns when executed properly. Combining contract flipping, owner carry, rent-to-own, and partnerships empowers you to expand your portfolio without large down payments. Start by educating yourself, forming solid legal agreements, and cultivating a network of buyers and partners. With persistence, transparency, and continuous improvement, investing in real estate without traditional financing can become a reliable wealth-building strategy.